The Index

The interest rate for an adjustable rate mortgage (ARM) loan is computed by summing the index and margin rates (interest rate = index rate + margin rate). The margin rate is the profit margin that the lender earns on the principle of the loan. The index rate may be based on a variety of different financial instruments.

Commonly Used ARM Indexes

Commonly Used ARM Indexes- Cost of Funds Index, 11th District (COFI)

- 1-Year Treasury Constant Maturity Rate

- 2-Year Treasury Constant Maturity Rate

- 3-Year Treasury Constant Maturity Rate

- Monthly Treasure Index (MTA), a 12-month moving average of B

- 1-Month London Interbank Offered Rate (LIBOR)

- 12-Month Average of the 1-Month LIBOR

- 6-Month LIBOR

- 6-Month Certificate of Deposit (CD) Rate

- Certificate of Deposit Index (CODI), a 12-month moving average of the 3-month CD rate

- Bank Prime Loan Rate

- Cost of Savings Index (COSI)

The current value of an index should be readily available from a published source, and it should not be influenced in any way by the lender writing the ARM contract. All of the indexes listed above meet both of these criteria except one, the Cost of Savings Index (COSI).

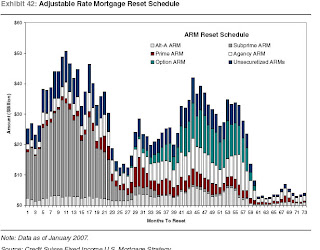

Understanding Option ARMs

They have been given many names: Option ARM, Pay-Option ARM, Pick-a-Payment ARM, Cash-flow ARM, and the list goes on... What they all have in common is that these products all feature a payment method where the interest you pay is based on an artificially low interest rate that's based on an index that the lender controls (COSI); rather than market conditions.

Option ARMs allow one to choose any of several payment methods monthly:

- 30-Year Fixed - fully amortizing over 30 years

- 15-Year Fixed - fully amortizing over 15 years

- Interest-only Payments

- A payment based on a below-market "payment rate" (usually 1%) which fails to cover even the interest which is due. In such an arrangement, the differential between what you actually owe and what you are paying is added onto the outstanding loan balance each month, a condition known as negative amortization.

The less you pay the more you pay...

If you pay less than the Principal and Interest (P&I) payment, your minimum payment will rise; even if the actual interest rate you are being charged doesn't. One of the reasons this can happen is compounding; as your principal balance (what you owe) increases, so does your minimum payment. The longer you make that minimum payment, the higher it will become. As a result, even if your actual interest rate should decrease, your actual payment due amount may not decrease; however, it may level out over the life of the loan... maybe.

The Devil is in the Recasting...

Option ARM loans require a recast (recalculation) when one of the following occurs (whichever happens first):

- The period specified within your loan documents (typically every five years)

- When the loan balance reaches the loan balance limit (typically 11o% to 125% of the original loan amount).

My Thoughts

For many, the whole point in securing an Option ARM loan was to make a significantly lower payment than what was required with a traditional ARM or fixed-rate mortgage. However, if you make use of that minimum payment it will increase over time, resulting in a payment that is significantly higher than the payments would have been for a traditional or fixed-rate mortgage respectively. Even more troubling is the fact that over time you may owe much more for your home than you initially paid for it.

Looking Forward...

The next article in the series, ARMed and Dangerous: Part Two will delve into the issues facing traditional ARMs.

No comments:

Post a Comment